The new financial year is almost here, and a new budget along with tax changes for businesses and individuals has already been introduced. In order to begin with your tax preparation for the new financial year, you must be aware of the changes in personal taxes made by the Minister of Finance and the Canada Revenue Agency (CRA).

Bill Morneau, the Minister of Finance, announced a new budget on February 27, 2018 (Budget 2018). The budget had some tax changes for businesses owners and individuals. To know what are the changes in personal taxes, let us first take a look at the existing personal tax. Here are the Federal Personal Income Tax Brackets and Tax Rates for the financial year 2017-2018.

- 15% on the first $45,916 of taxable income, +

- 20.5% on the next $45,915 of taxable income (on the portion of taxable income over $45,916 up to $91,831), +

- 26% on the next $50,522 of taxable income (on the portion of taxable income over $91,831 up to $142,353), +

- 29% on the next $60,447 of taxable income (on the portion of taxable income over $142,353 up to $202,800), +

- 33% of taxable income over $202,800.

According to the new budget, the federal tax rates are unchanged, but the brackets have been changed by an indexation factor of 1.015. The indexation factors, tax brackets, and tax rates have been confirmed by the Canada Revenue Agency (CRA). The new federal tax rates for 2018-2019 are as follows:

- 15% on the first $46,605 of taxable income, +

- 20.5% on the next $46,603 of taxable income (on the portion of taxable income over 46,605 up to $93,208), +

- 26% on the next $51,281 of taxable income (on the portion of taxable income over $93,208 up to $144,489), +

- 29% on the next $61,353 of taxable income (on the portion of taxable income over 144,489 up to $205,842), +

- 33% of taxable income over $205,842.

Your federal tax rate is based on your income. The federal tax is the portion of your taxable income before any credits and benefits. Apart from paying the taxable amount to the Canada Revenue Agency, a specified percentage has to be paid to your province too. This additional amount is known as the provincial income tax.

Here are the provincial taxes for Alberta for the financial year 2017-18.

- 10% on the income up to $126,625, +

- 12% on income between $126,625.01 and $151,950, +

- 13% on income between $151,950.01 and $202,600, +

- 14% on income between $202,600.01 and $303,900, +

- 15% on income over $303,900.01

According to the changes suggested, the provincial tax brackets and tax rates for the province of Alberta look as follows:

- 10% on the first $128,145 of taxable income, +

- 12% on the next $25,628, +

- 13% on the next $51,258, +

- 14% on the next $102,516, +

- 15% on the amount over $307,547

Some Additional Information Regarding New Tax Changes and Payments:

- Self-employed individuals have until June 15, 2018, to file their return.

- From February 26 to April 30, 2018, the CRA will be offering extended evening and weekend hours for Individual Tax Enquiries. The lines will be open from Monday to Friday (except holidays) from 9:00 am to 9:00 pm (local time) weekdays, and from 9:00 am to 5:00 pm (local time) on Saturdays.

Source: https://www.canada.ca

In order to ease the process of filing your personal tax returns, you can hire an accounting firm. Get in touch with us, and we will help you gain the right tax benefits and ensure you file the correct tax amount.

Are you managing your accounting and bookkeeping on your own because you haven’t found the right accountant in your city? Or are you doing it because your in-house resources are unable to manage the constant pressure of bookkeeping? Whether you don’t have a trusted accountant in your city or your in-house staff are not knowledgeable in bookkeeping and accounting, virtual accounting services can be an ideal solution for you.

Virtual accounting services are the usual accounting, bookkeeping, and financial services remotely provided online by a team of accountants, or ‘virtual accountants.’ Let us explain some of the top benefits of virtual accounting services.

Less Paperwork, More Productivity

When you have an in-house accountant or bookkeeper who doesn’t use the proper accounting software and/or applications, your office can be flooded with lots of paperwork. Keeping track of paperwork and maintaining physical books can be challenging and time-consuming. But, when it comes to virtual accounting services, virtual accountants maintain and update every detail of your records within one type of software and provide a dashboard for you to access. This means no paperwork at your workplace and more productivity thanks to the online resources.

Timely Access to Accounts

As a business owner, you might want to take a look at your financial statements and reports at any hour of the day. Another benefit of virtual accounting services is that you can access your financial statements 24/7 from any part of the world. When you have an in-house accountant taking care of your accounts, you have to ask for your account statements and wait to receive them. But when it comes to virtual accounting services, they will provide all the reports and statements you need on a daily basis, so the information that will help you run your business is right at your fingertips.

Low Cost

When you opt for virtual accounting services, you can save yourself a significant amount every year. If you have an in-house accountant, you will have to pay them a salary, bear their sick leave pay, payroll taxes, recruitment costs, employee benefits, etc. But when it comes to virtual accounting services, you will receive a package of varied accounting, budgeting, and bookkeeping services at affordable prices. Unlike physical accountants, you can avail these virtual services for 365 days a year without paying extra.

Flexible Hiring

Virtual accounting services can be hired on a need-basis. There are months when your accounting and bookkeeping needs will be higher. For instance, when you want to file your tax returns, you will need your accountant the most to calculate the taxable amount and pay the taxes on time. Similarly, there may be months when you won’t need an accountant. If your accounting and bookkeeping needs are low, then you can opt for part-time virtual accounting services. This way, you not only save on the cost of hiring a full-time in-house accountant, but also on the full contract of virtual accountants.

Virtual accounting service providers are a team of accountants who use secured software to get the job done for you. Companies that hire virtual accounting services have been more successful at growing their business, increasing revenue and reducing cost. So, then if you are considering virtual accounting services for your business, then get in touch with Rutwind Brar.

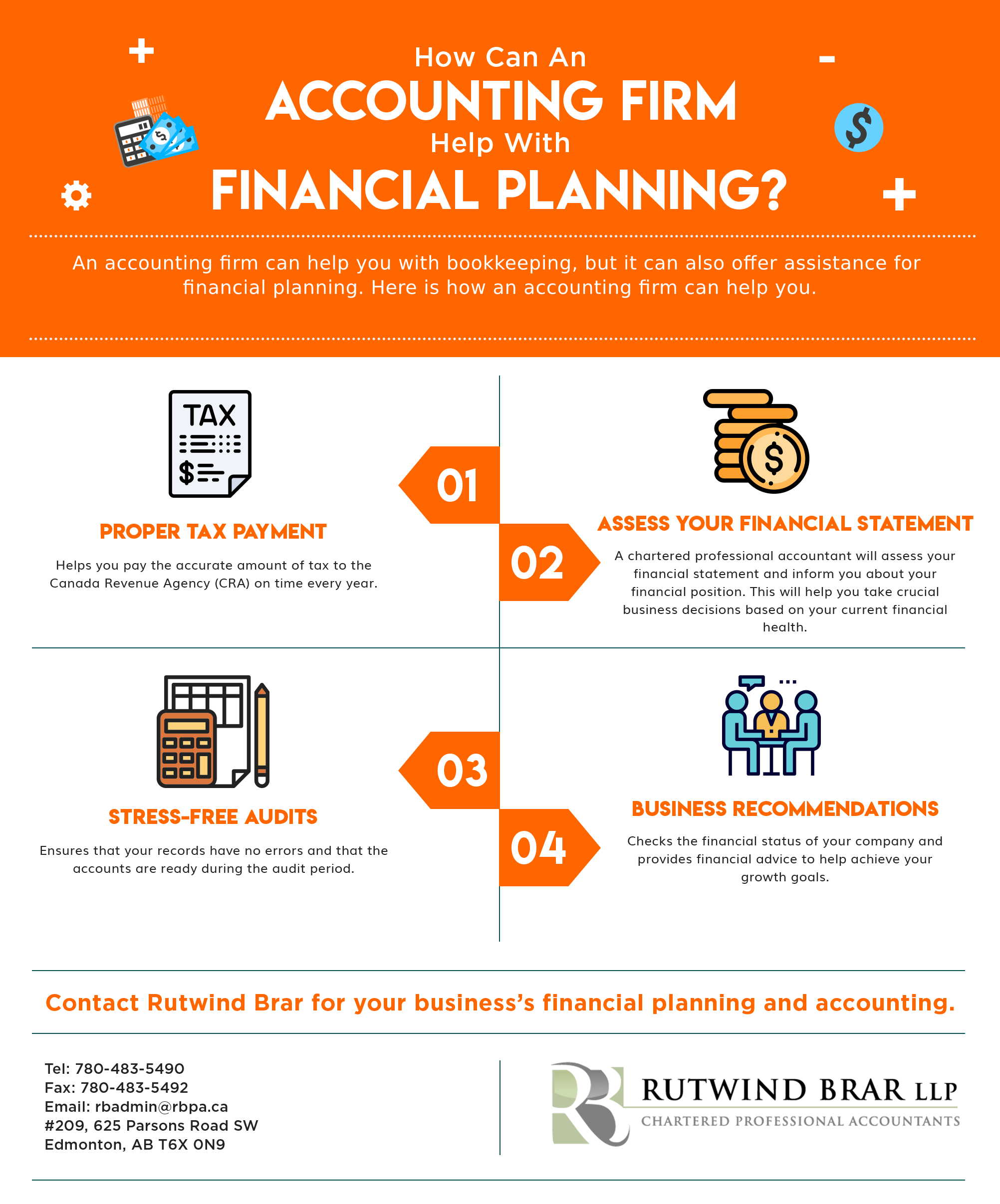

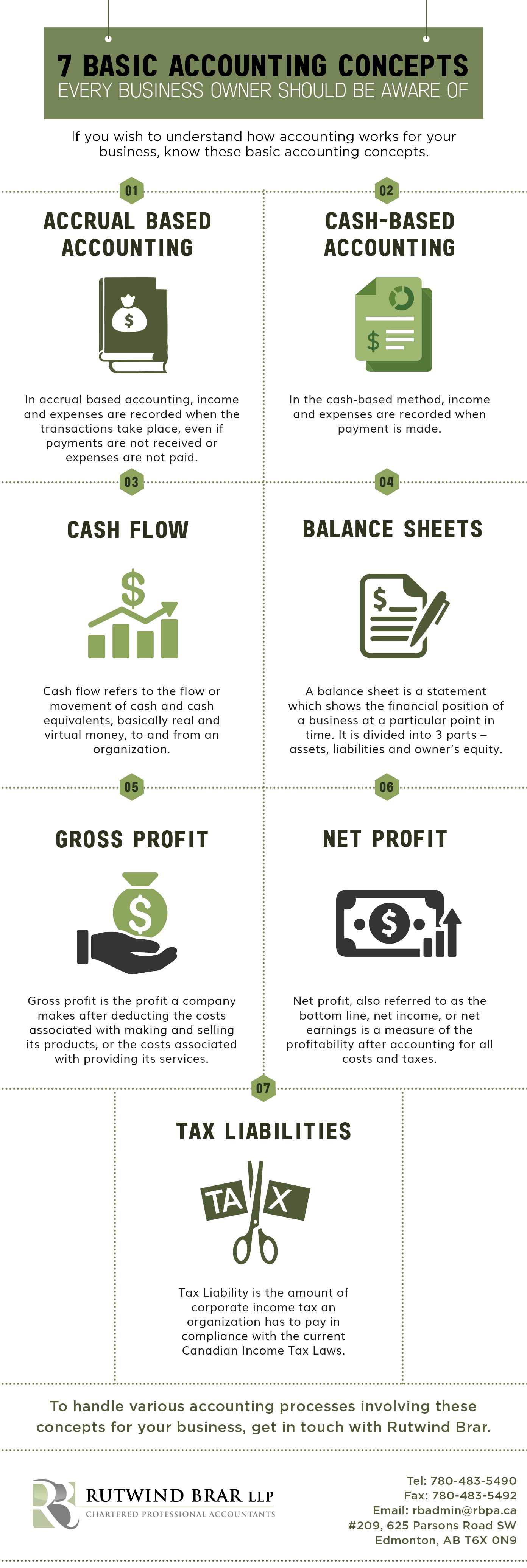

Managing your finances and books of account can be a tedious task when you run a business. It is all the more difficult when you lack the basic knowledge of accounting. The solution is to hand over the work to a chartered professional accountant. A chartered professional accountant is a member of a profession which was created in Canada after an amalgamation of three professions, Certified General Accountant (CGA), Chartered Accountant (CA) and Certified Management Accountant (CMA). A chartered professional accountant is a professional who handles important accounting and income tax related issues and works on advising and consulting businesses to make better financial decisions. To give you a picture of what a chartered professional accountant does, here are some key benefits of hiring a chartered professional accountant.

Comprehensive Accounting Knowledge

Whether you have a large, mid-sized or small business, maintaining your accounting books is essential. Trying to do it on your own may seem feasible to you but could be a bad decision if you lack the extensive knowledge required to do so. When you hire chartered professional accountants, they bring with them their knowledge and expertise in accounting. The combined nature of their job role helps you with your bookkeeping, tax management, and business advisory as well.

Better Decision Making

As mentioned before, the extended job role of a chartered professional accountant makes them a highly knowledgeable person when it comes to accounting. Their knowledge can come in handy for your business as a chartered professional accountant will be able to help you with financial planning and decisions based on your firm’s current position.

Detailed Expertise in Taxation

For any business owner, the major discrepancies that happen in their accounting system are because of the lack of accounting and tax knowledge. The problem is not the lack of willingness to pay the tax but the lack of awareness about tax laws, rules, deductions, required tax returns, and deadlines. Having a chartered professional accountant to guide you fills up this gap of unawareness and ensures that you do not fall behind on your tax filings. They also help you claim deductions which you may have not even heard of, thereby saving your money.

Varied Services

A chartered professional accountant is a comprehensive profession which works on the varied accounting services which a business requires. When you choose to hire an internal accountant, he comes with the knowledge of one person. But when you hire a chartered professional accountant from a good accounting firm, their knowledge and services are not limited to just one person, and you get access to the varied services they provide which will prove helpful for your business.

When we talk about the smooth functioning of a business, we plan to run it successfully. With your finances and accounts managed by a chartered professional accountant, you have an updated statement of your accounts. Also, having someone to take care of your accounts enables you to work on other business related responsibilities. So let the professionals work on your accounts while you work on your business.